December’s Market Insight Report is now available

2025 year has been a strong year for submissions, with all regions across England seeing an increase in the number of applications submitted.

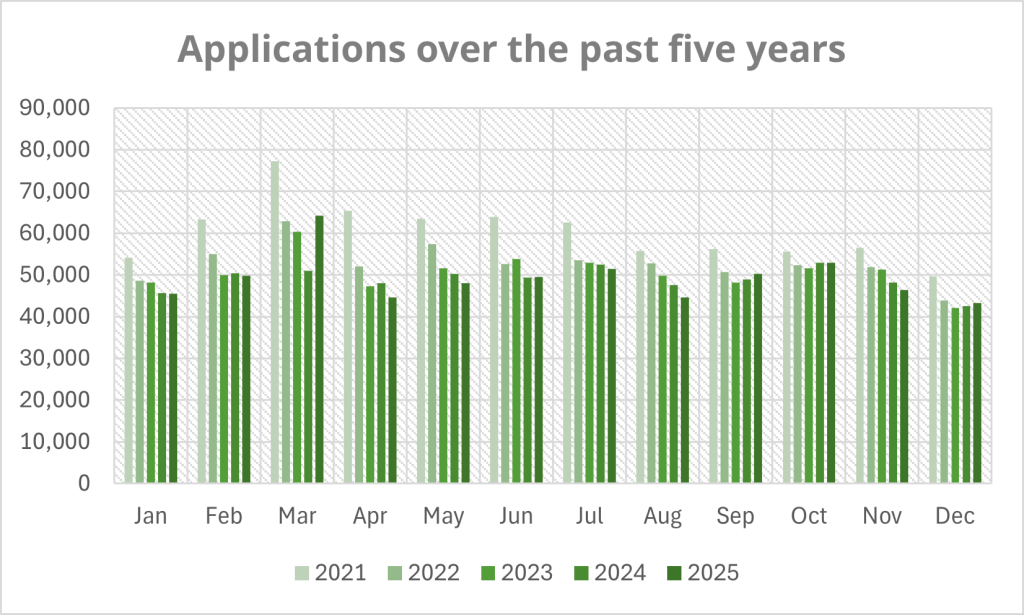

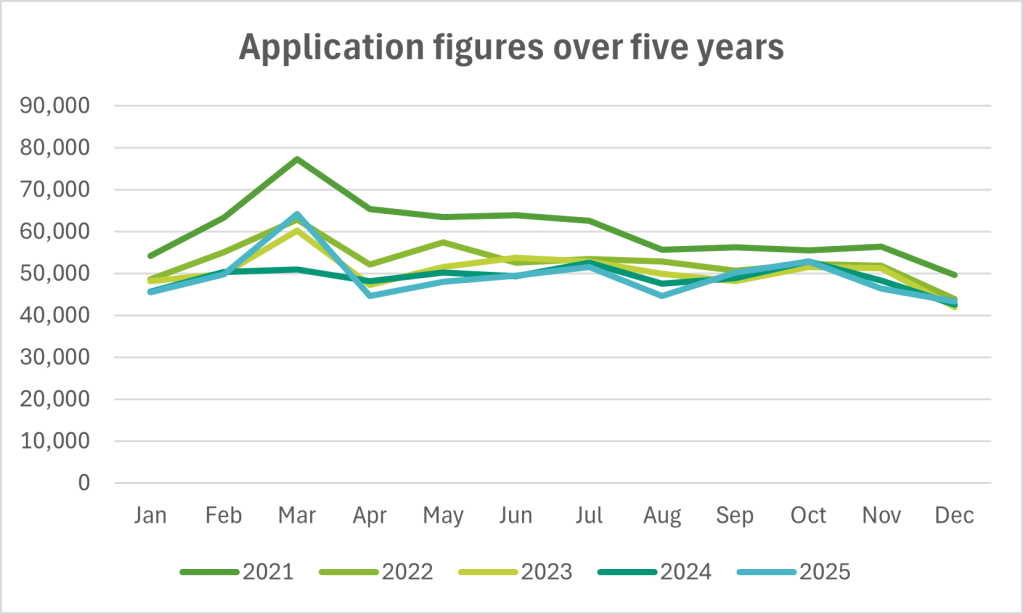

Total applications

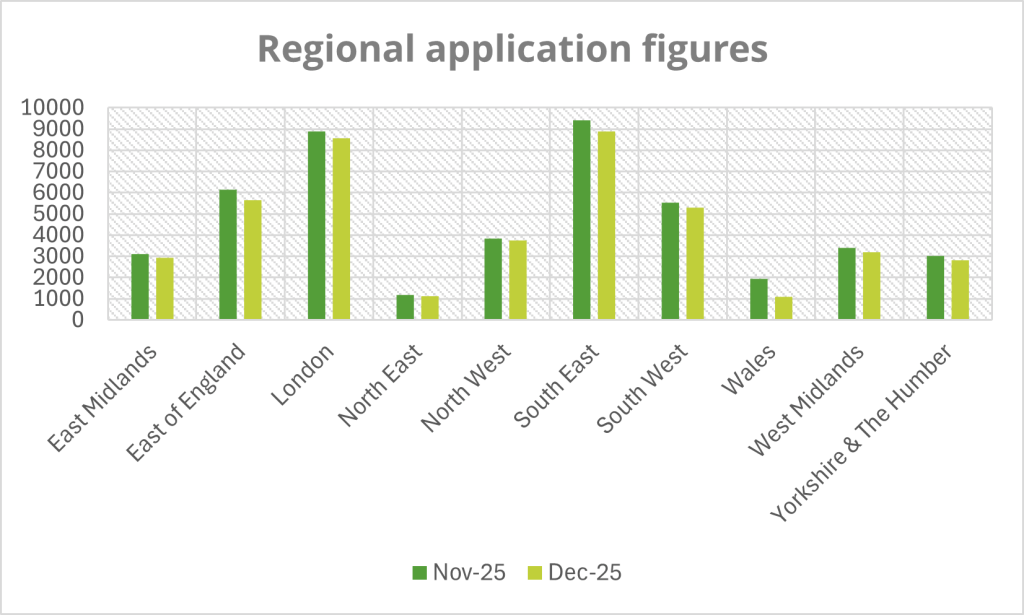

Compared to December of 2024, this December saw increases in application numbers across all regions, with the exception of Wales, which actually had 31% less applications. Both The East of England and Yorkshire and the Humber saw significant 9% increases. Compared to November 2025, however, December 2025 didn’t perform as well – which is the continuation of a well documented seasonal trend. Across all regions, the decrease averaged at 9%. The smallest decrease between the two months was in the North West region, which saw a 2% decrease.

Regional

The East of England received 10% more applications in 2025 than it did in 2024, with the North West and the North East regions both receiving 7% more applications than in 2024. December 2025 saw a 4% increase in applications submitted against the previous December, but was down against November 2025 by 7%.

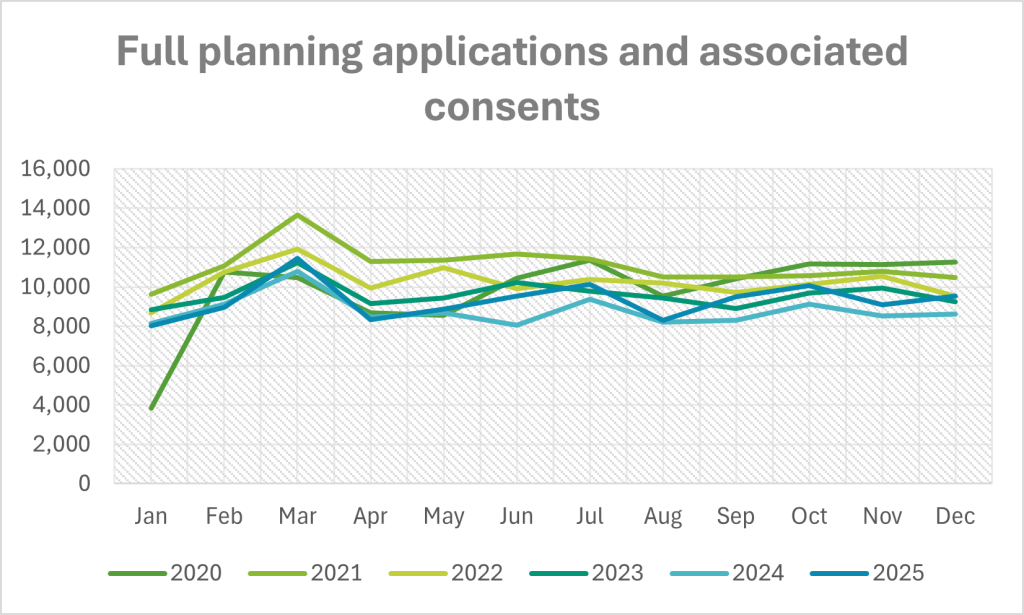

Full applications

Full applications were up 11% compared with December 2024, but down against November 2025 by 5%.

Householder applications

Householder applications, meanwhile, decreased by 4% compared to the same month the year before, and 7% when compared to November 2025. Furthermore, applications for larger home extensions decreased by 2% compared to December 2024.

Outline applications increased by 49% in December 2025 when compared to December 2024, reflecting an interesting increase in this application type against last year.

Conclusion: What we learnt in 2025

December’s figures round off what has been, overall, a resilient and positive year for planning application activity. Despite the expected softening in application submission from November to December, which consistent with seasonal patterns, 2025 comfortably outperformed 2024 across most regions in terms of submissions. Strong growth in full applications and the striking rise in outline submissions suggest renewed confidence in longer-term development planning, even as household-level activity cooled slightly.

This year, we’ve also made it our mission to track application figures for individual housing units through our Planning Application Index series. Housing unit application figures have sharply increased in 2025. As we’re one of the only sources tracking this publicly, our reporting has gathered significant interest across industry. We believe the sharp uptick has shown that recent reforms are motivating an increase in will to develop housing – and we’re seeing increased developer intent.

Regional variation remains an important part of the picture. The broad-based increases across England underline steady national demand, while Wales’ sharper decline on applications shows that market dynamics are not uniform and will be worth monitoring into 2026. Taken together, the data points to a market that is active, adaptable, and still planning ahead, even against a changing economic backdrop.

As we move into 2026, a key question will be whether the momentum in outline applications and rising unit numbers can convert into real, delivered development on the ground. Significant roadblocks and delays still exist beyond the point of submission, and these will need focused attention if increased intent is to become meaningful progress on housing supply. Nonetheless, current trends point to a sector that has absorbed recent uncertainty, adapted with resilience, and is now positioning itself for a period of sustained – and potentially accelerated – activity in the year ahead.

Comments are closed.