May’s Market Insight Report is now available

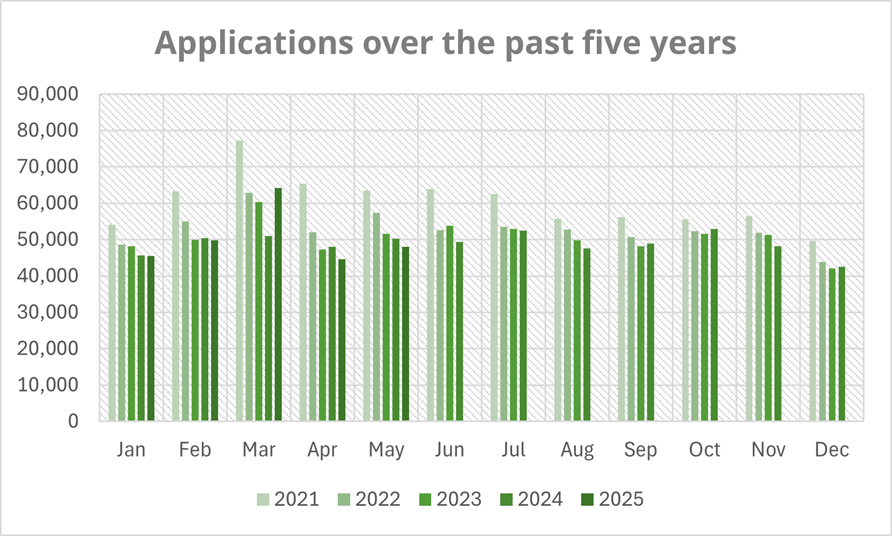

After a subdued April, planning application activity rebounded in May, with 48,020 submissions – an 8% increase on the previous month (nearly 3,500 more applications) and a modest 1% rise compared to May 2024.

While volumes remain below previous years – 15% below May 2022, for example – the increase signals a potential resurgence in development intent, as the market recovers from the post fee-hike slowdown last month. The impact of this renewed development ‘intent’ was explored at length in our recent Market Index Report – analysing application insights from Q1 of this year.

Month-on-month growth is typical for this time of year, but the sustained uplift hints at a broader return to stability, building on seasonal patterns seen since 2021.

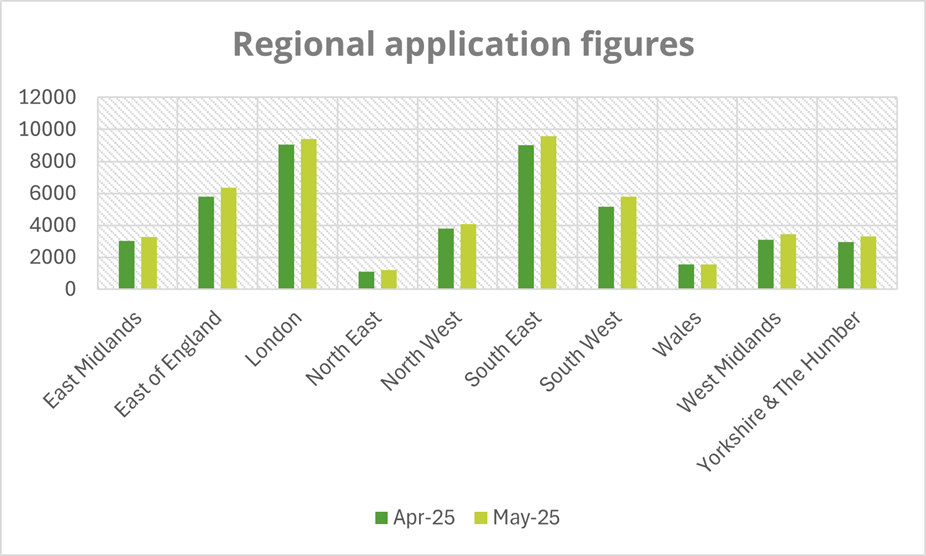

Regional trends – most areas up, with less activity in Wales

All regions saw a rise in planning activity when compared with April. Eight out of ten regions saw growth of 7% or more, with the South West seeing the largest rise at 12% – equivalent to 620 additional applications. Wales recorded the smallest change, with just three more submissions than the previous month.

Most regions also recorded a modest increase when compared with May last year, with the East of England leading at 7%. Other areas saw changes within a narrow band of -1% to +2%, apart from Wales, which experienced a notable 16% decline in planning applications compared to last year.

London also saw a small drop of 1%, equating to just 117 fewer applications.

Looking at year-to-date figures, planning activity remains elevated across the board. The East of England has seen the strongest growth in both percentage and absolute terms, with a 10% rise representing 2,917 more applications. Yorkshire and the Humber also posted a 10% increase, while all English regions have grown by at least 6%. Wales, meanwhile, has remained relatively flat, showing a minimal year-to-date increase of just 1%.

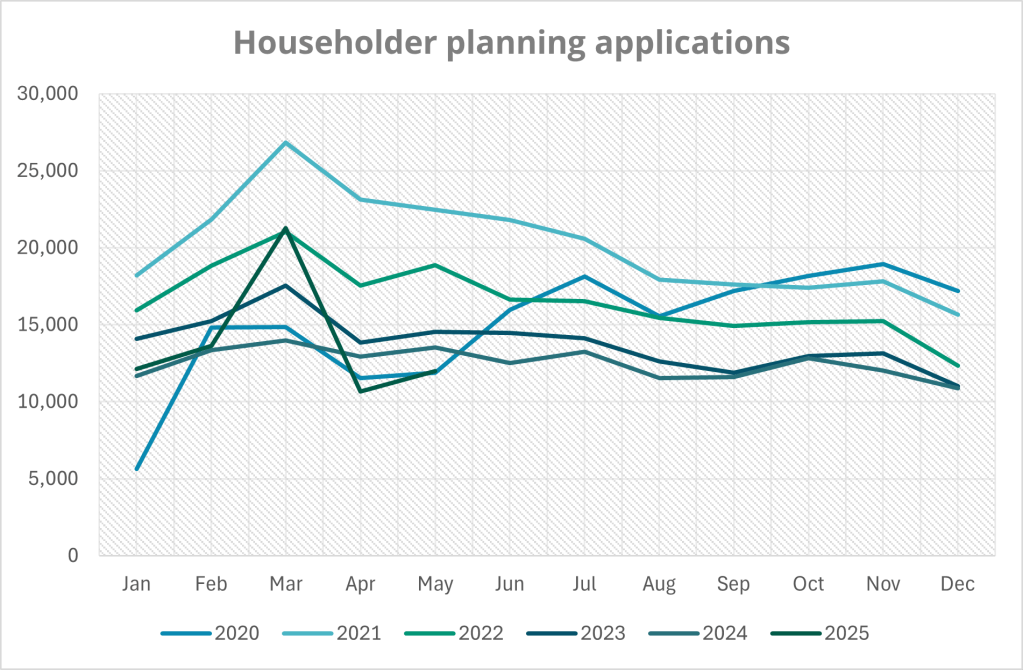

Applications by Type

Householder applications were down 11% in May compared to the same month last year, representing over 1,500 fewer submissions. However, they rose sharply against April of this year’s figures, increasing by 12% – a notable rebound given that this category was the most impacted by the government’s recent planning fee hikes.

While volumes remain lower year-on-year, this data suggests that the immediate effects of the fee increase are already easing, with activity showing signs of recovery.

Full applications also showed modest growth in May. Submissions increased by 7% month-on-month -with nearly 550 more than in April – and by 2% year-on-year, with 206 additional applications submitted in May 2025 compared to the same period last year.

Overall, May saw modest gains in application volumes, reinforcing the outlook shared in our first Market Index report of the year: that development intent is gradually strengthening, spurred in part by ongoing government reforms.

Comments are closed.