October’s Market Insight Report is now available

October Sees Seasonal Growth Despite Annual Decline

October 2024 saw a boost in planning activity, aligning with the seasonal growth typically observed at this time of year. This increase also represents a slight uplift compared to October 2023, indicating some stability amid a challenging year for the sector. While cumulative figures for 2024 continue to lag behind where we were on submissions at the same point last year, regional variations highlight pockets of resilience, with the East Midlands and London showing encouraging year-on-year growth.

October saw a notable rise in planning application numbers against the previous month, with Planning Portal processing 52,915 applications, an 8% increase compared to September. This mirrors last year’s seasonal pattern, where October applications rose 7% against September.

October 2024 recorded a 3% increase in total applications compared to the same month last year.

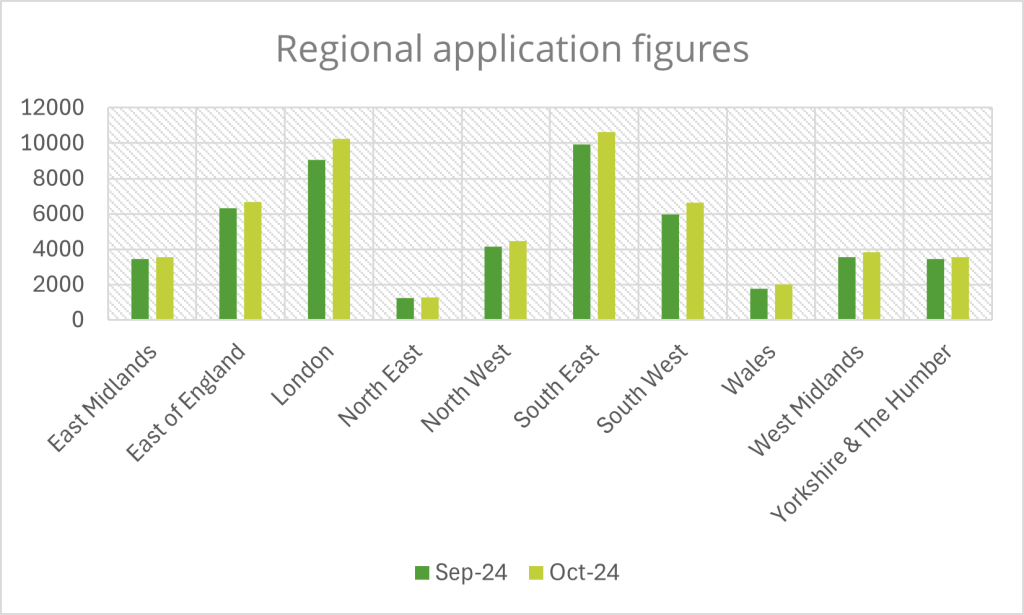

How do October’s figures look in different regions?

As we know however, the cumulative figures for the year do not reflect October’s upsurge. Applications remain down by 18,800 compared to this point in 2023, with declines observed across all regions. Among these, Wales has experienced the smallest decrease—just 267 fewer applications year-to-date—while the South East has recorded the largest drop, with 4,125 fewer.

Despite the annual decline, most regions showed stability when compared with October 2023, with some even reporting growth:

- East Midlands stood out with a 7% increase in applications compared to October last year.

- London experienced the largest real increase, with nearly 300 additional applications compared to October 2023.

Month-on-month, every region recorded more applications in October than September, with particularly strong performances in Wales, London, and the South West with each saw 10–15% growth.

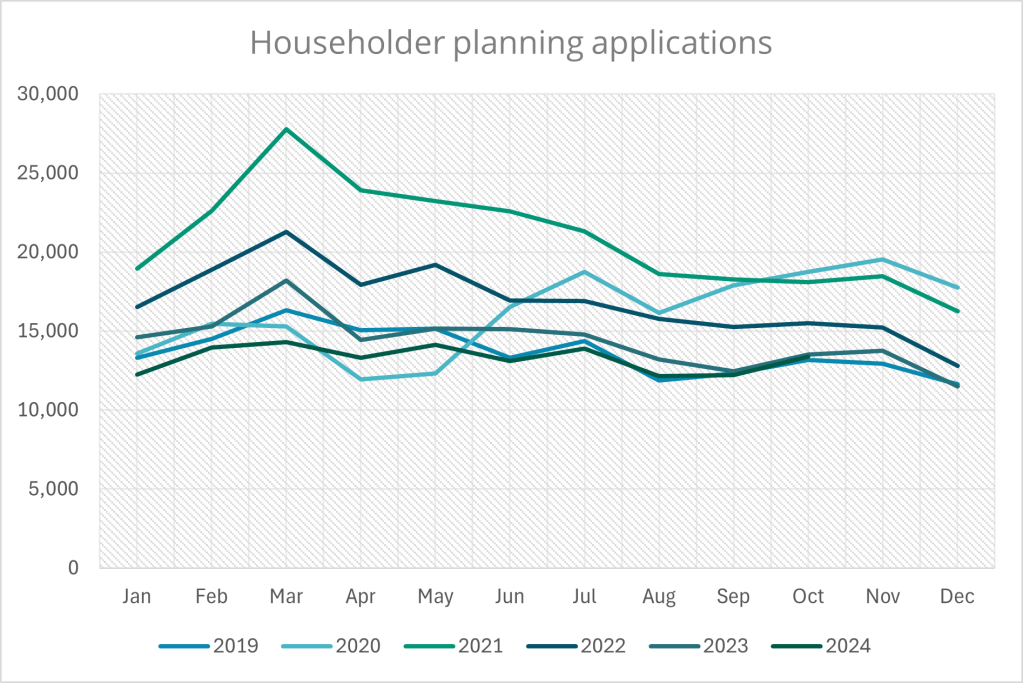

Submissions by type

Against September, October saw an increase in the main application types, with householder application up by over 1,000 and Full planning applications up by 771.

Yet compared to October 2023, unsurprisingly the primary application types have all showed modest declines:

- Householder applications: Down 1%.

- Full planning applications: Fell by 5%.

Outline planning applications: Experienced the steepest drop, down 21%.

October consistently demonstrates a seasonal boost in applications, reflecting broader trends in planning over the later months of the year. So, whilst annual figures continue to lag behind 2023, regional resilience and growth in smaller application types provide a nuanced perspective on the market’s performance.

Looking ahead, we will continue to track these trends through November and December, providing a clearer picture of potential long-term recovery and shifting national planning priorities. This is especially significant in the context of evolving legislation and changing national development goals.

For a deeper dive into planning trends, explore our Planning Market Index report. This seasonal publication offers a comprehensive analysis of application trends, development pipeline insights, and expert commentary from key industry stakeholders.

With early access to application data from across England and Wales, we provide valuable foresight into the changing planning landscape. For more detailed insights, please contact us at communications@planningportal.co.uk.

Comments are closed.