May’s Market Insight Report is now available

Welcome to May’s issue of the Planning Portal Market Insight Report, where we report on the latest figures for applications submitted online via the Planning Portal.

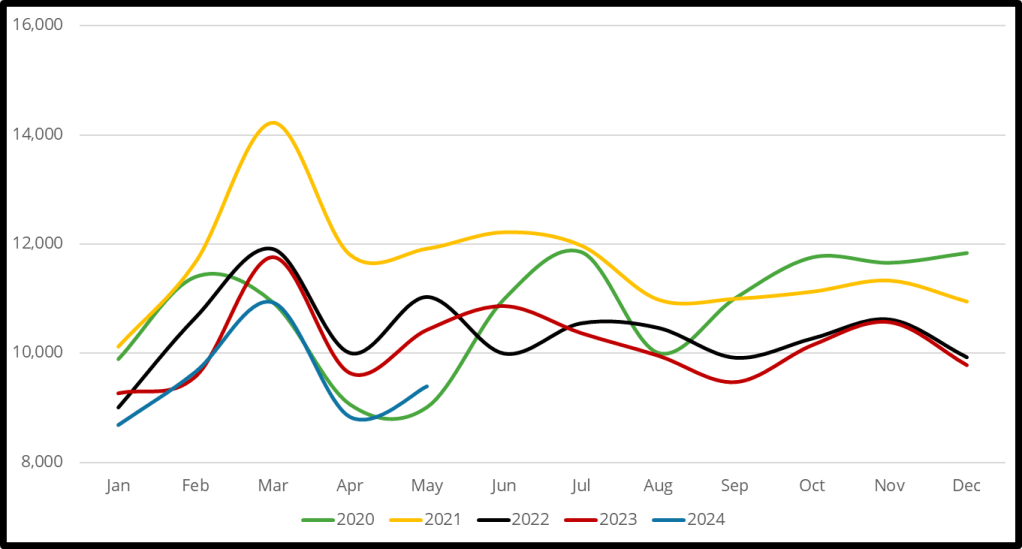

There was a total of 50,254 applications submitted through the Planning Portal in May 2024. This is 3% lower than the total number of applications that were submitted in May 2023, showing a gradual decline, less severe than the trend in recent years.

This month we saw a 4% increase in submissions than last month. This is most likely due to the Easter holiday period. However, we expected a recovery in May as the lower volumes in April were due in part to a surge in submissions at the end of March. This was before ‘small sites’ became subject to biodiversity net gain requirements from 2nd April.

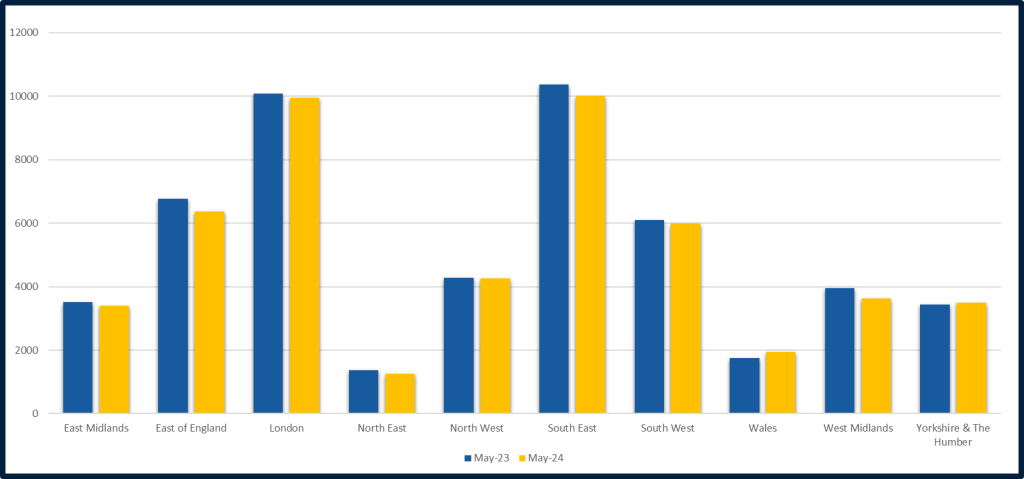

The regional view

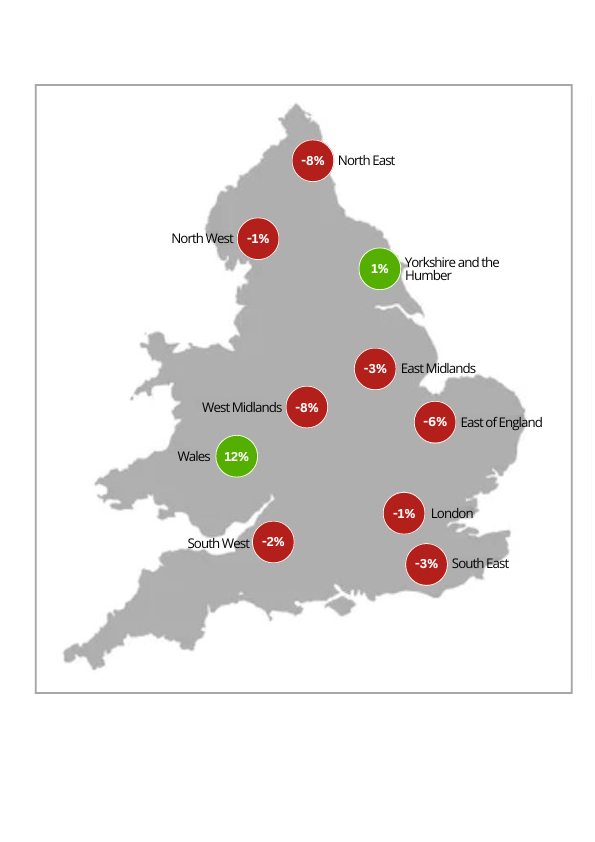

This month, every region in England saw a small percentage increase when compared to April 2024, with the North East seeing the largest proportional increase at 12%. This was only an additional 133 applications, far fewer when compared to the highest volume increase of 371 application submissions in London.

Wales had an additional 61 applications compared to the month prior, a 3% increase from April 2024.

The general trend shows a single digit percentage decrease for all English regions, whilst Wales saw a 12% increase compared to May 2023. The largest decreases of 8% were seen in the North West and West Midlands.

The South-East and London once again received the highest volume of applications, slightly either side of 10,000 applications respectively.

The map below shows the percentage change in the number of applications submitted per region in May 2024, compared with May 2023.

Applications by type

The table below shows how applications by type have risen or fallen, compared with May 2023.

Householder applications saw a 7% decrease, full applications saw a 10% decrease and outline applications saw a 25% decrease in planning applications. These have all declined compared to May 2023. This could be attributed to several potential factors, but the decline mirrors the continued decrease in submission volumes that we have seen since the middle of 2021.

However, advertising applications (whether standalone or part of a planning permission), applications to vary or remove conditions, and various prior approvals related to the creation of dwellings have all increased compared to May 2023.

Householder and Associated applications

Householder applications are at a decline of around a thousand applications when compared to May 2023. However, these are at an increase by almost two thousand applications from April 2024. This closely matches numbers from March, which is often the busiest month.

Lawful development applications remained very similar to last year, having slightly increased from April 2024, mirroring this month’s overall increase.

Full Planning applications

Full applications also dropped by around a thousand applications when compared to May 2023. However, these were also at an increase of 6% from April 2024, returning to more of a ‘normal’ level, albeit being on a continued downward trend.

A series of changes that have increase the scope of permitted development rights for solar projects, change of use to dwellings, and agricultural buildings continue to shift more submissions from full planning to prior approval.

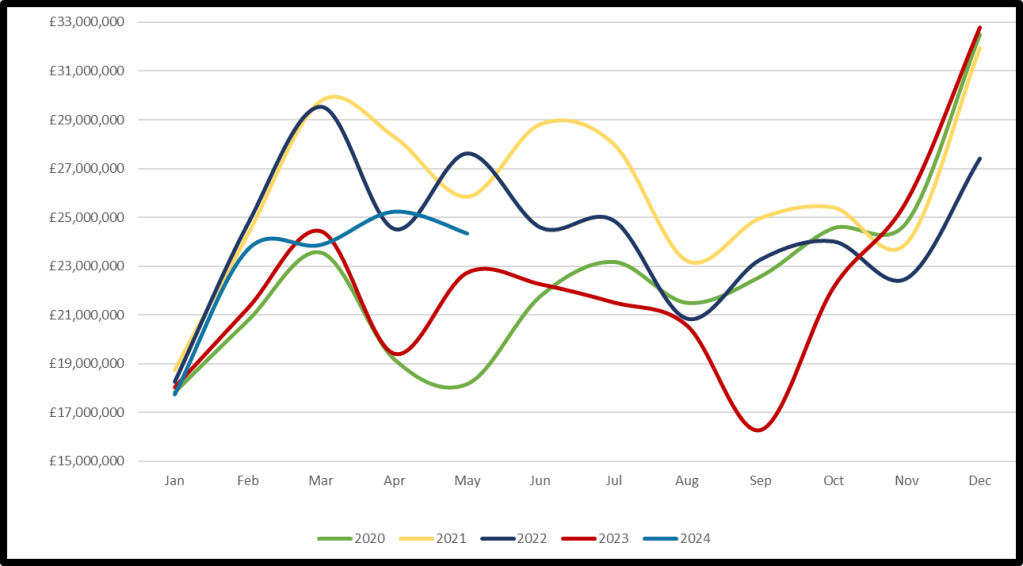

Planning fees processed for online applications

A total of £24,341,193 in planning fees was processed in May 2024, around 7% higher than May 2023. This is almost a million less than in April 2024. This broadly aligns with the combined effect of falling submission numbers and increased fees.

The Planning Portal has access to online application data exclusively available at the point of submission to Local Planning Authorities. The insights this data provides allows you to gain an early idea of what’s being applied for throughout England and Wales. If you would like to access this data on a more granular level, please email: communications@planningportal.co.uk

To access this data first, subscribe to our mailing list here.

Comments are closed.