April’s Market Insight Report is now available

Welcome to April’s issue of the Planning Portal Market Insight Report, where we report on the latest figures for applications submitted online via the Planning Portal.

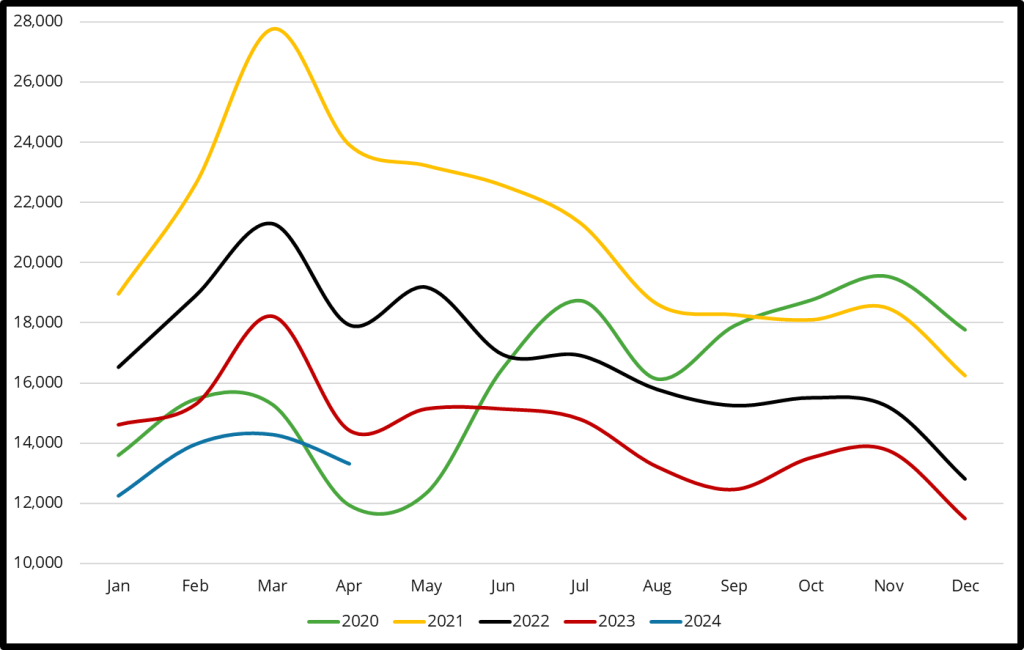

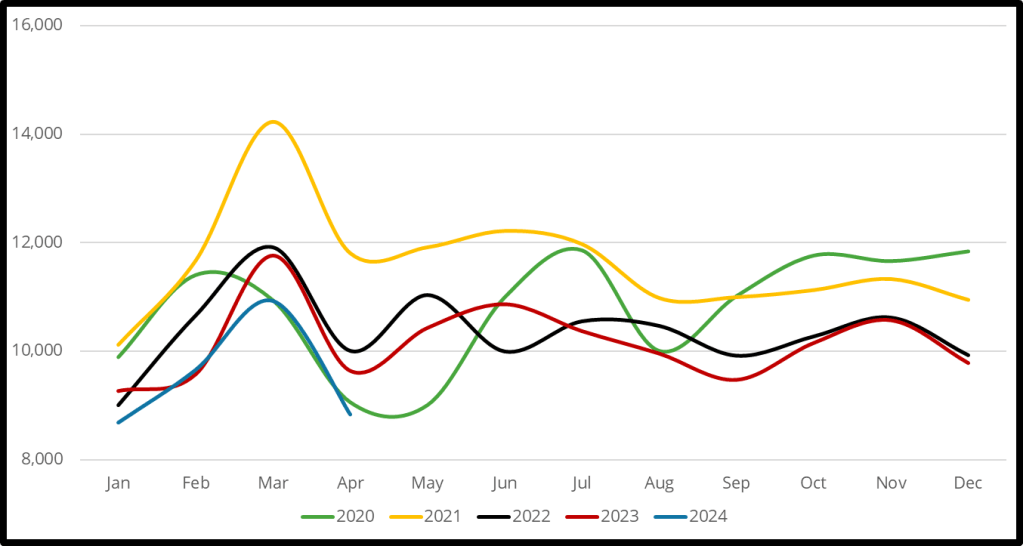

There was a total of 48,094 applications submitted through the Planning Portal in April 2024. This is 2% higher than the total number of applications that were submitted in April 2023. showing a gradual decline, less severe than the trend in recent years.

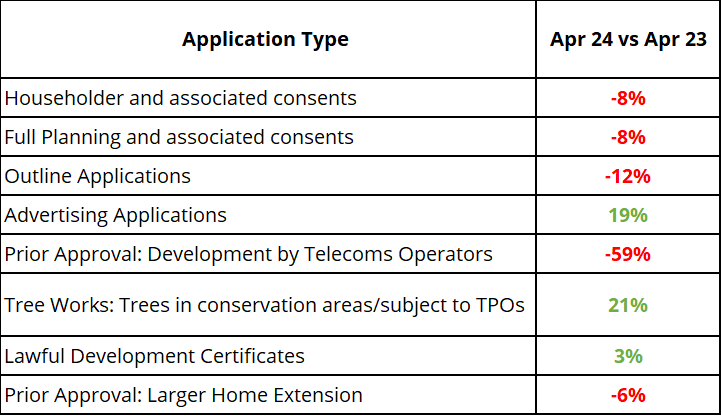

The greatest shift in April was for minor application types such as advertising, applications for tree works and lawful development certificates. All seeing increases compared to April 23.

Householder applications, full applications and outline applications have all declined by 8-12% against this month last year, primarily due to Biodiversity Net Gain (BNG) requirements being implemented for small sites at the beginning of the month.

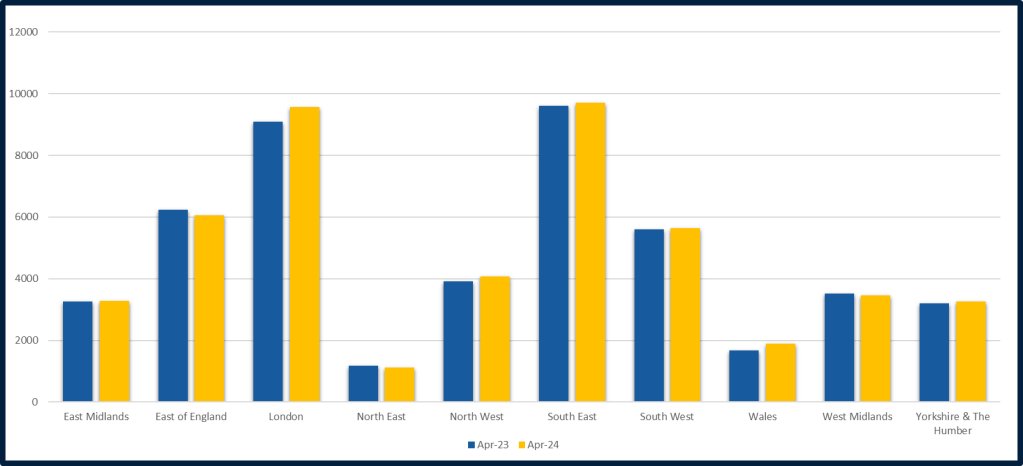

The regional view

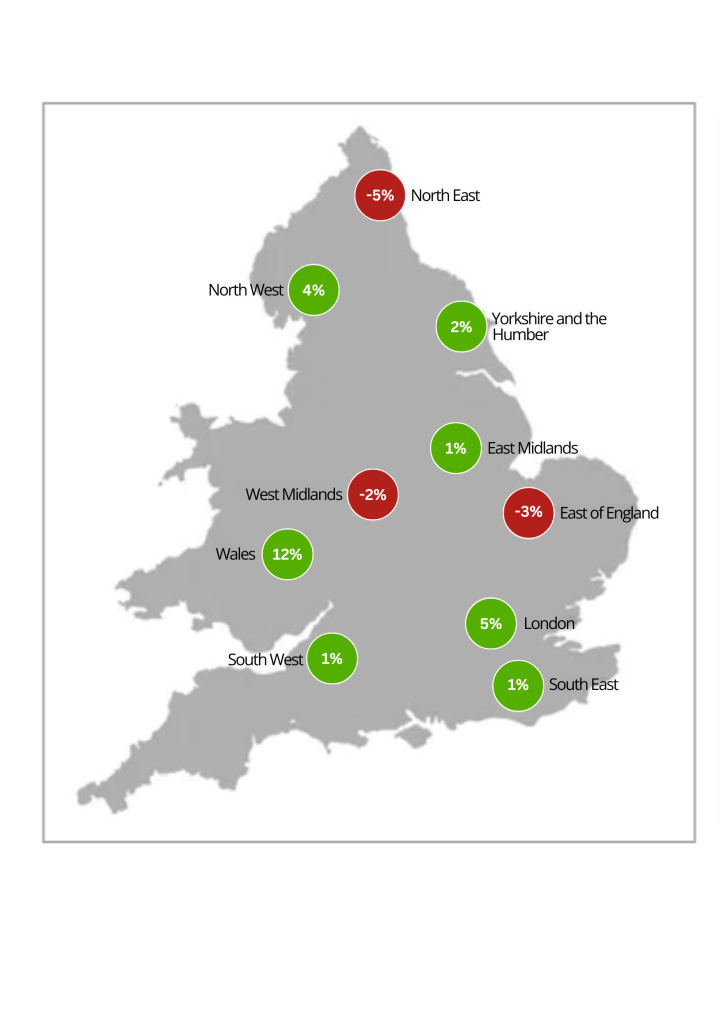

This month every region in England saw a negative percentage decrease, while Wales had a minor uplift in applications against March 2024. Wales had an additional 110 applications compared to the month prior, alongside a 12% increase against April 2023.

The general trend shows all regions, except Wales, remained at a similar volume compared to April 2023. The biggest variance is London with a 5% increase and the North-East with a 5% decrease.

The South-East received the highest volume of applications, slightly exceeding 9,700 with London following at 9,572.

The map below shows the percentage change in the number of applications submitted per region in April 2024, compared with April 2023.

Applications by type

The table below shows how applications by type have risen or fallen, compared with April 2023.

Householder submissions saw an 8% decrease this month compared to last year with just under 12,500 applications. Prior Approval for larger home extensions followed a similar trend and were 6% down, this is a shallower decrease than previous years in April.

The major increases for this month were advertising applications and applications for tree works, up by 19% and 21% respectively. For tree works this means an increase of almost 1,000 applications against last year.

Householder and Associated applications

Householder applications saw a decrease of over 1,050 applications against April 2023. This is the second lowest number of householder submissions this year.

Other applications for lawful development certificates had a minor increase by 3.5% compared to last year. Suggesting an increase in people completing smaller changes or using extended permitted development rights opposed to householder applications.

Full Planning applications

Full applications were at a significant decrease in April, largely a result of the influx of applications seen throughout March due to the new BNG requirements.

Compared to April 2023, full applications were down 8%, this is a combination of the overall yearly trend we’re seeing and the BNG requirements mentioned above.

We would expect May’s applications to return to a normal level, as those bringing submission forward to avoid BNG regulations likely would have submitted in March.

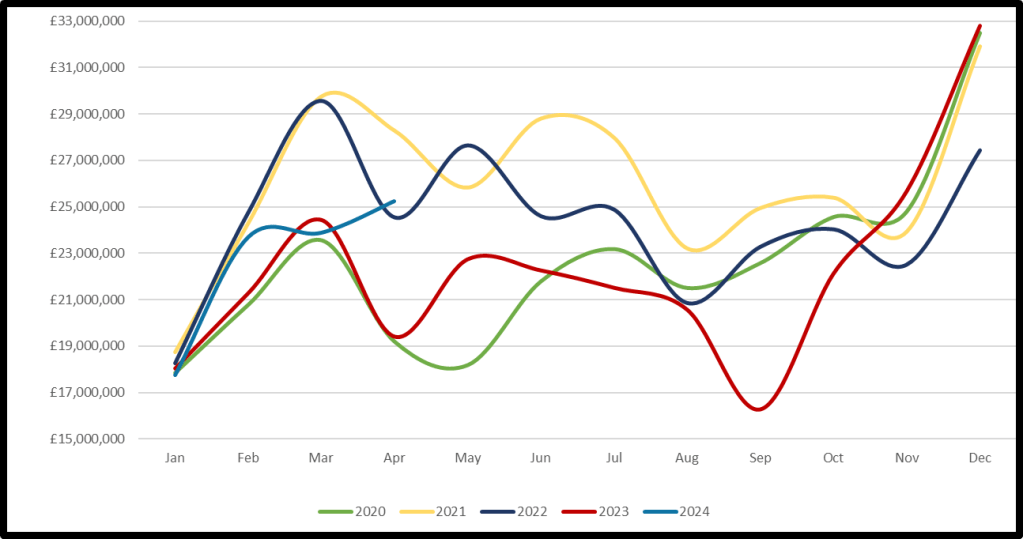

Planning fees processed for online applications

A total of £25,233,121 in planning fees was processed in April, a whopping 30% higher than April 23. This is reflective of the increased planning application fees introduced in November, alongside a 2% increase in overall submissions.

It is hoped this additional income will allow authorities to better resource their departments and become more financially sustainable in terms of their overall service delivery costs.

The Planning Portal has access to online application data exclusively available at the point of submission to Local Planning Authorities. The insights this data provides allows you to gain an early idea of what’s being applied for throughout England and Wales. If you would like to access this data on a more granular level, please email: communications@planningportal.co.uk

To access this data first, subscribe to our mailing list here.

Comments are closed.